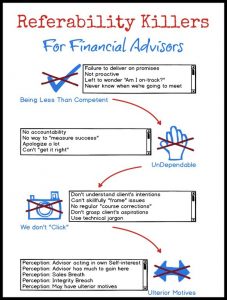

There is much written for financial advisors regarding “what to do” to acquire Ideal Clients, but this piece will focus upon the four biggest reasons why clients don’t refer their financial advisor, and why Potential Ideal Clients choose not to work with a financial advisor. Let’s examine four repulsive traits which will lose Clients also serving as an effective “going-out-of-business strategy.”

1. Being Less Than Competent

Unfortunately, many advisors give frequent signals that they aren’t very good at what they do.

For starters, failure to deliver on your promises made at the beginning of the relationship is a big red flag. If you claim to be proactive and have good follow-through skills, Clients will quickly figure out whether that’s true or not.

Clients should never be left to wonder if they are on-track or not. If, at every client meeting, you don’t quickly establish those client goals which are on-track as well as any which are off-track, you are sending a negative signal about your competency. Clients want their financial affairs and their goals to be on-track; they expect you to recommend regular course corrections whenever things get off-track.

Having all your meetings scheduled a year in advance also shows competence while defeating one of the most common client complaints about financial advisors: “I don’t know when I’ll next see my advisor.” This will also eliminate the common complaint that many finacial advisors “hide out” under their desks when the financial markets are not rosey.

In the end, if you don’t make Clients’ lives easier, then your competence is in question. Clients want their list of action items to be shorter because you are in their life, so advisors who just push tasks onto the Client’s plate are not perceived as particularly competent. The stakes are too high in a Client’s mind, and there are too many financial advisors around to put up with anything less than skilled competence. An advisor who stays on top of everything and continually takes action to shorten every client’s list of action items is considered invaluable.

2. Lack of dependability

Are you on time to meetings and phone calls, or do you make Clients wait? One of the biggest measures of your dependability is how well you serve in your role as your Client’s “accountability coach”, meaning how well you hold everyone in your Client’s financial life accountable, including yourself. Do things often go wrong around you? Do you find yourself apologizing a lot? I’ve heard it said that Clients want you to “get it right,” rather than continually having to “make it right” when things go wrong.

3. Failure to “click” with Clients

“Clicking” is the ability to fully understand and connect with a client’s intentions. Clients not only want an advisor who will frame issues skillfully and is able to recommend regular “course corrections” as needed, clients also value an advisor who understands them. Do you know your Client’s aspirations well enough to represent them in a meeting with their accountant or estate lawyer? Failure to forge a solid connection with those things which matter more than money to your Client indicates a superficial relationship. The more superficial your client relationships are, the less referable you are.

Along this line, another turn-off, which does not resonate with Clients, and which reduces your referability, is the use of technical jargon. Clients detest advisors who talk over their heads. Simple language which helps your Clients make decisions builds trust and referability. If you truly want to resonate and “click” more with your Clients, read the book Values-Based Financial Planning by Bill Bachrach to help your Clients make a clear connection between their goals and their values.

4. Having ulterior motives

If a Client feels you might be making a particular recommendation because you’d benefit from it, then the bond of trust is breeched, and you may not even know it has happened. If you make a recommendation and your Client smells even a subtle hint of “sales breath,” trust can evaporate in an instant, and you may not even be aware of it.

Clients who feel an advisor does not act with integrity, or is acting in their own self-interest, mentally assign their advisor a negative Referability Rating. Insisting upon “full transparency” is the perfect, perhaps only, way to inoculate yourself from any perception of concealed or ulterior motives. Convincing your Clients that you are the one person in their financial life who is protecting them from potential conflicts and financial dangers results in a lift in your referability in ways which are difficult to grasp. Most Clients have no idea what they’re currently paying for the financial products they hold, and you can fix that. Being the person who routinely reports exactly how much your Client is paying for financial products and services is practically unheard of. Clients will trust and refer you when you make it clear that you view your role, in part, as a pledge to protect their financial assets by creating transparency around the costs.

Finally, to increase your referability, set expectations with each Client up front. In summary, explain exactly what they will get for the money they’re paying you, and be candid about any gaps in service. Show your dependability by always having the next 12 months of meetings scheduled on the calendar. Begin to ask and understand each Client’s perspectives and values. Understand each Client’s financial heading well enough to be able to represent them in meetings with other professionals; then, ask for the privilege to accompany Clients to these meetings, and offer to prepare these other professionals by briefing them in advance. Finally, be totally transparent by reporting exactly what each Client is paying for their financial products and services, and you’ll not only be highly referable, you’ll be irresistible.

Responses