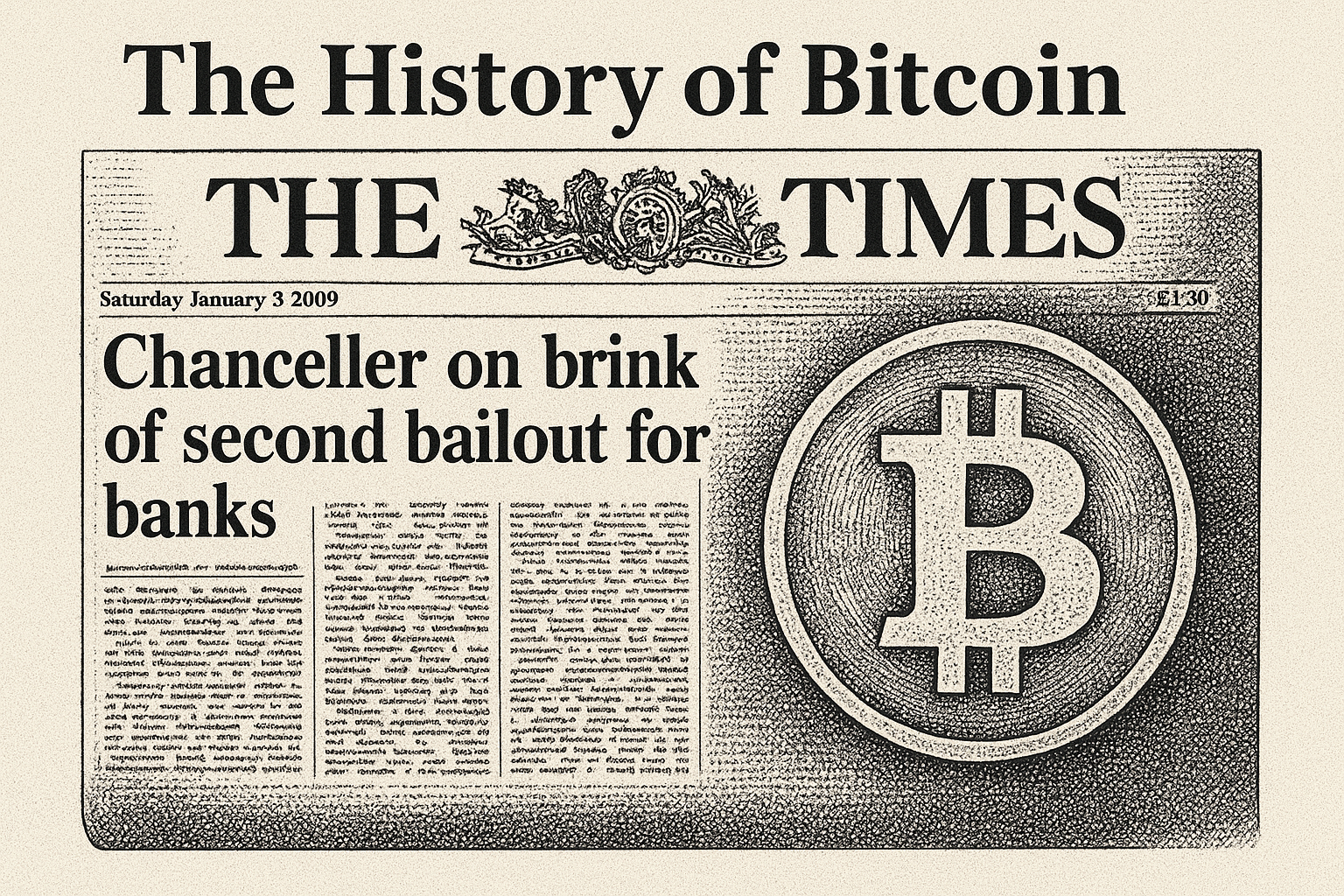

In our world it is easy to wave Bitcoin away as speculation. But the bigger story matters to our clients and to our credibility. I wrote an article about The History of Bitcoin specifically for Financial Advisors who want a clear view of what Bitcoin is, why it was created, and how to talk about it with affluent families without hype or hand waving.

After reading, you will be able to explain the origin story that began with a loss of trust in 2008 and why a rules based monetary network emerged from that moment. You will be able to place Bitcoin within monetary history beside gold, central banking, and fiat, and show how scarcity, settlement, and finality work in a digital system.

With Bitcoin a client can “wire” any amount of money, half-way around the world in seconds… no bank involved. You will see why the network has persisted for more than a decade despite volatility, shifting regulations, and attempts to copy it, and why its design choices are different from every other crypto project: governance by users, predictable issuance, and security funded by energy and math.

You will also know how to frame client conversations.

- What problem does Bitcoin solve for savers.

- Why time horizon and position sizing matter. How to separate price action from fundamentals like issuance schedule, miner incentives, and global liquidity.

- What it means to own a permissionless asset that settles without intermediaries.

- What is Bitcoin mining and can’t Bitcoin be hacked? Is it secure?

- How to acknowledge risk without resorting to fear or vague dismissals.

The goal is not to sell, but to provide clarity so clients can decide with eyes open.

Bitcoin adoption is growing exponentially, whether or not you want it to. It’s coming, and high end clients do not require us to predict the next move. They do expect us to understand why thoughtful investors are allocating to a digital bearer asset and how that decision interacts with their lifetime plan.

- When we can articulate the long arc of the idea, we win trust.

- When we shrug, we lose it. A clear framework beats opinion. I have spent 40 years advising families and training advisors. The ones who stay curious keep their edge.

If you want an even handed perspective you can use in the next client meeting, start here.

You will come away with language for explaining what Bitcoin is and is not, how to evaluate it as part of a diversified strategy, and how to keep the conversation grounded in first principles and real world constraints. That is what our clients pay us for. It is our job to translate complexity into choices clients can live with now.

Read the full article for Financial Advisors on The Mark of Mastery:

(You’ll need set a password for access, but it’s free and then you’ll also have access to all our Ideal Client research, advanced planning ideas, as well as content for consistently exceeding Ideal Clients’ expectations)

Responses