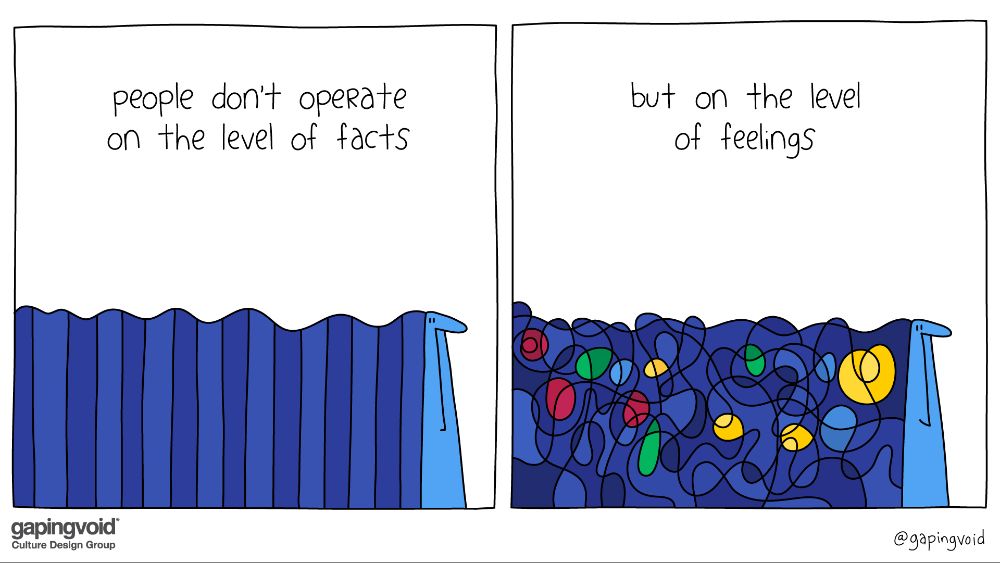

The more affluent the Ideal Client, the more decisions are based on emotion rather than facts. The more successful and the more affluent the client’s family, the more their significant decisions are based on emotion rather than on logic simply because the stakes are higher.

As their Financial Advisor, you’re in a perfect position to help your clients face this emotional reality. The quicker you can skillfully get your Ideal Client to understand this truth, the sooner you can work together to make better decisions.

A book that can help skilled professional Financial Advisors understand this tricky dynamic is called PREDICTABLY IRRATIONAL by Dan Ariely. Any Ideal Client who insists they make all their decisions, regarding Significant Financial Issues, based solely on logic & facts, the more you need to help them face facts.

By understanding when they’re operating on emotion that in itself will help your Ideal Client to make better decisions. You can help them get there. Reading Dan’s book will allow you the time & context to think about how to relentlessly challenge client decisions based on emotion, but in a way that calms the situation rather than inflaming the issue.

The only thing you cannot do, as a Financial Advisor, is agree that a bad decision is based on logic when it’s clearly emotional. Don’t just give in to a bad decision, when you know it’s based on emotion and likely to harm them financially. With Ideal Clients, you’re in the big leagues where silence regarding uncomfortable topics is not an option.

What you must do is learn how to skillfully & dispassionately help clients understand, and navigate through emotional decisions, when their every instinct is to act on emotion. Your success as a Financial Advisor hinges on your ability to point out that it’s actually a discipline that avoids mistakes, never emotion (or gut feelings). Emotion is the problem in finance, it’s never the solution, even when affluent clients swear they trust their “gut.”

Don’t be that Financial Advisor who agrees with every crazy emotional decision your Ideal Client proposes. Rather, become that steady person in their life who’s skillfully able to confront bad decisions before they’re implemented. Help your Ideal Clients avoid damaging their own finances when they give in to emotions whenever the markets or world headlines make them nervous. Worry less about “losing the client” and more about leading your clients. Truly successful Ideal Clients will recognize & value this in you because it’s rare.

Home » All the Feels

FREE WEBINARS

for dedicated Financial Advisors

All Times in US-Pacific

About Mark McKenna Little

Mark Little is the ‘regular guy’ Financial Advisor whose unconventional approach to financial services acquired 1,242 clients.

Then in just 34 months he rebuilt his business from the ground up, shattering international records and boosting revenue by 412%

Free Membership includes

- The Only Game In Town: (audio) 10 Game-changing Strategies for Financial Advisors

- Acquiring Successful, Affluent Clients: 10 Critical Lessons for Gaining Affluent Clients

- Become the ‘Most-Trusted’ Financial Advisor: 10 Essential Lessons for Successfully Serving Affluent Clients

- The Kate Wilson Case Study: (audio) Learn how a Real Life Financial Advisor Rapidly Transformed her Practise using Mark’s advice.

- Mark’s Weekly Digest: valuable insights and updates, delivered to your inbox.

(Opt Out any time via any issue)

No credit cards, Unsubscribe any time, No strings attached (just sign up for instant access)

Responses