What Financial Advisors Miss About the Wealth Gap

Many financial advisors, like you and me, serve high-net-worth families—but how often do we stop and consider the systemic forces that helped build and preserve that wealth? And what are the risks we’re missing, that we need to focus on to protect our clients?

The headlines about wealth inequality are everywhere. But for those of us who serve productive clients, responsible individuals and families—many of whom reinvest in their communities and businesses—the conversation feels more complex than the slogans imply.

This article reframes the discussion in terms every advisor should understand: proximity to capital.

Scott Bessent recently explained it this way:

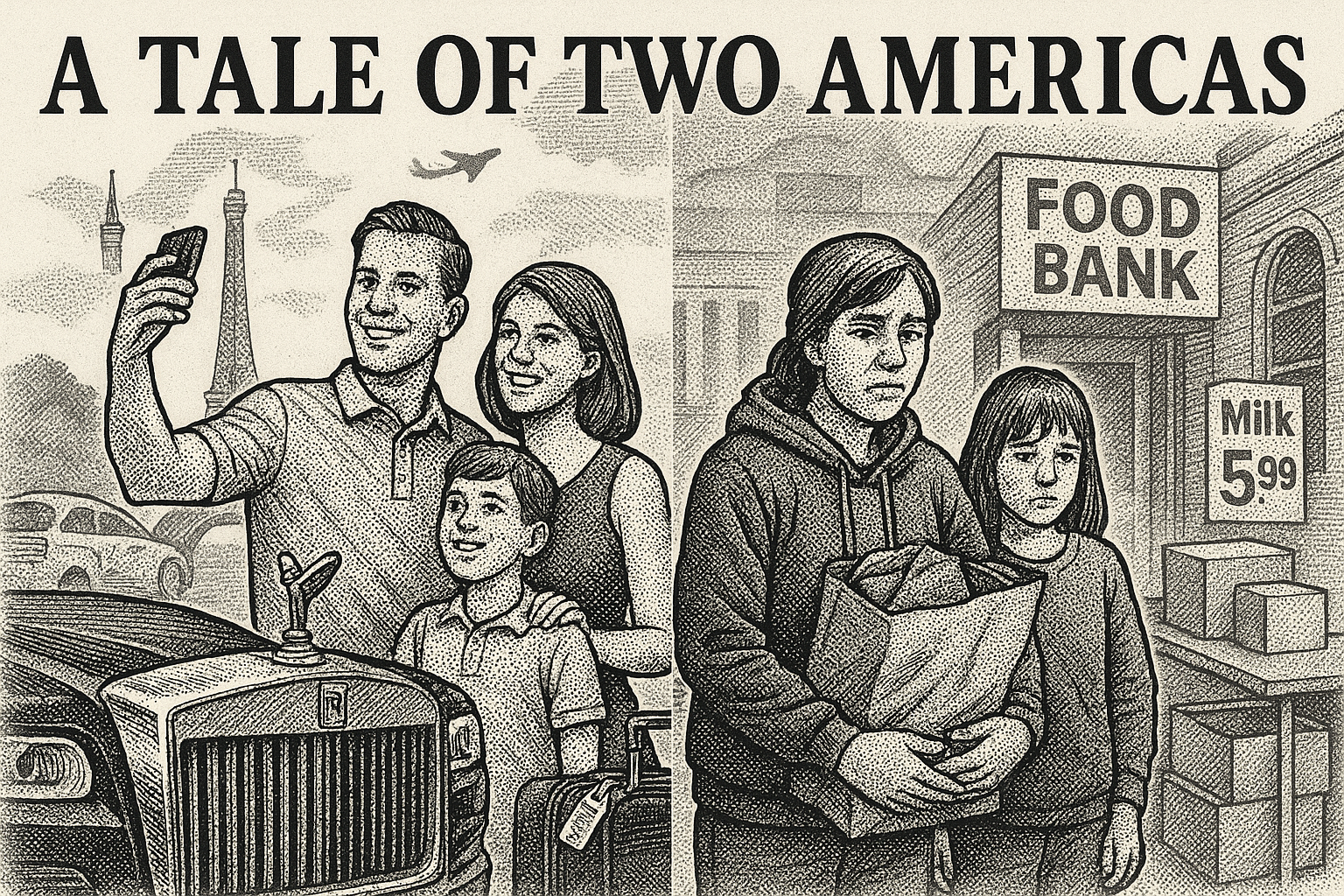

“The top 10% of Americans own 88% of equities. The next 40% own the remaining 12%. The bottom 50%? They own debt.”

From ZIRP to capital surpluses, from the Cantillon Effect to asset inflation, the article explores how monetary and trade policy have quietly distorted asset values. Those who already owned assets benefited the most. Those without were left navigating rising living costs, stagnant wages, and inflation-driven instability.

Even trade deficits—usually discussed in isolation—have fed this loop. Dollars sent abroad to purchase goods return as foreign capital buying up U.S. equities, farmland, and real estate. The result? Asset prices continue climbing, while affordability and opportunity decline for many.

This isn’t just a policy issue. It’s a framework issue.

As advisors, we need to think clearly about how monetary dilution, capital flows, and distorted markets are affecting our clients and our strategies.

The full article connects these dots—and poses an uncomfortable question:

If monetary inflation is driving asset bubbles, what assets are being quietly excluded from this inflationary cycle? And why?

I wrote this article for Financial Advisors to better understand what you might have missed in the past, and might need to focus more on today to protect your clients and their wealth in this period of uncertainty. I discuss the asset classes that have not been targeted by tariffs or wars and appear to be holding up well.

Read the full article here:

Responses