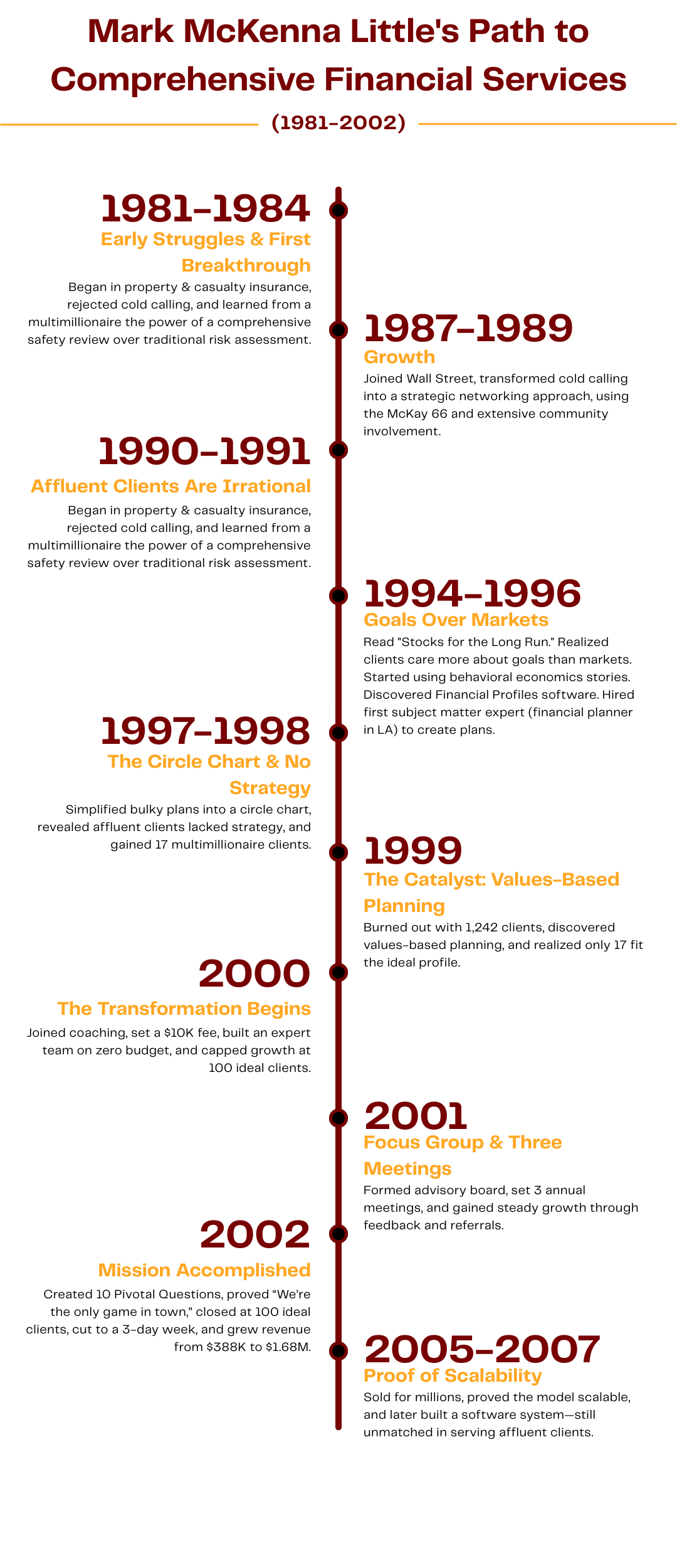

In this audio recording, Mark McKenna Little describes his professional journey in the financial services industry, spanning over two decades. It documents his struggles with traditional sales approaches, key paradigm shifts, breakthroughs, and eventual development of a client-centered model focused on values, strategy, and comprehensive planning.

Transcript

Ian: [00:00:00] This is Ian Hood. I’m with Mark McKenna Little and we are having a conversation about his early days in the industry and how all of his revelations and paradigm shifts took place over really more than 20 years. We’ll start right away with 1981.

Mark: All right, so I was hired by a property and casualty company.

Mark: They tried to put me through sales training. That’s when I read the book by Tony Alessandra called Non-Manipulative Selling. And I rejected selling and I realized that I could add clients by looking for fit rather than trying to persuade or push things onto them. Then 1982, um, the next year I basically, my management was forcing me to do cold calling, but I just completely replaced cold calling with interviewing existing clients.

Mark: It was a huge company, and I just said, just give me a bunch of existing. Policy holders, I don’t care if their agents long ago, left the company, let me just call ’em [00:01:00] up and offer to service them. And that worked. I started getting referrals, but it sucked me into all this service work that I was not adding clients fast enough.

Mark: So by 1983, the management, they said, well, that’s working, but it’s not working well enough, so we need you to go back to start cold calling again. So, which I hated. So I did that until 1984. But somewhere in the middle of 1984, I think mid like summertime, uh, I quit because what I decided to go was just go back to grad school.

Mark: I didn’t, I didn’t like the insurance business anyway, like the property and casualty. It was workers’ comp and dealing with business insurance and things like that. But I, I didn’t like it. So in 1984, right before I quit, I had this breakthrough conversation with, with a client. He was a multimillionaire. A business owner, and I was trained by the company when you, when you sat down with somebody that owned a business to kind of go through a risk assessment so that obviously you’re looking for insurance.

Mark: Right? Okay. [00:02:00] So in the middle of that, he liked me, but he just stopped me and he said, he explained, he goes, whoa, whoa, whoa, all of this. He goes, this whole going through what you’re doing, I mean, you’re calling it a risk assessment, but let me just tell you how somebody like me looks at this. It’s an insurance pitch.

Ian and Mark: Yeah.

Mark: I said, so what do you wanna do? What would be better? And he said, let’s talk about how to increase the safety of my whole plan, my situation, my business, and everything. So we started talking about that, and then we, so I made a list. Of those things. And it turns out half the things on the list had nothing to do with insurance.

Mark: Like I, I put here the quote where he said Hi, his biggest risk is he thinks his kid, he thinks the kid that wants to marry his daughter just wants her for her money, right? And I’m like, well, there’s no insurance for that. So, but anyway, what it did was it re it got everything out on the table and then we came up with strategies for everything.

Mark: And as a result, I sold more insurance than I ever had to any client. So it was, so I created this [00:03:00] whole comprehensive safety review as a concept to replace the insurance, kind of the traditional risk assessment, which is what the insurance. Industry teaches you. Right. So that was in 1984, believe it or not.

Mark: Wow. So then I went back to school and I kind of bounced around. I, I ended up not liking grad school. I, I ended up hating law school and I did not like finance MBAI, I didn’t like any of it. Uh, to me it wasn’t entrepreneurial enough. It was just training you to kind of go back into mid-level management in a corporation.

Mark: Mm-hmm. So by 1986, a friend of mine said, well, I just got hired by Merrill Lynch, so why don’t you come interview, uh, or at least interview around. I had a reputation with my friends. You know, I owned a bunch of stocks and I had been tracking stocks since I was 12 years old. And everybody knew that. And they said, well, why don’t you go talk to a stock company?

Ian and Mark: Hmm.

Mark: So I did, by March of 87, I got hired by a Wall Street [00:04:00] based firm. Then the first thing they did, I thought, oh great, I’ll be working with investments. But of course, the first thing they did was, you know, throw the phone book at me and tell me, start cold calling 300 people a day.

Ian: Yeah. That’s where everybody starts, right?

Mark: So after a year of that, I was on the verge of quitting that. I’m like, this is not what I meant to get into. And then, then I read this book in 1988 called Swim with the Sharks Without Being Eaten Alive by Harvey McKay. And he had this thing in there, I told you about the McKay 66, which I adopted, and it turned into the MISC organizer.

Mark: And, uh, basically I found out two things. Number one is I found out that getting to know potential clients and asking them, uh, who they did all these things with, that really led to an increase in introductions like. Like as you went through the McKay 66 or, you know, I had changed the list quite a bit, but in essence it was to ask them who, who did you do these things in your life with?

Mark: That was the, that really led to an increase in referrals. The second thing I discovered was that, that thing I [00:05:00] told you about how, how you’re trained in the industry to ask, so who do you know that that. Triggers an automatic response. But if I changed it around, and I found in my notes, the question I asked was, how could I get on their radar screen?

Mark: So let’s say, Ian, you said, oh, you know, uh, the best vacation we ever took was five years ago with the neighbor next door. We all went through Italy, we spent the summer going through Italy. And I said, who’s we? And you said, oh, it’s our neighbors on the other side. And you go, okay, who are they? So, so then I’d say, how would I get on their radar screen?

Mark: That was my question. That was my signature question. So it, it was very disarming. They didn’t feel like I was even asking for a referral. It was more like just a, Hmm, I wonder how you would get on their radar screen. Right. So sometimes they would say, well, you know, they’re very active in the American Heart Association.

Mark: Maybe you could, you know, meet ’em there. And then sometimes they just said, why don’t I just, uh, introduce you? You know? Right. So it was kind of like really took the pressure off. Yeah, that’s so much better. Yeah, and I just kinda stumbled across that, that’s not [00:06:00] taught anywhere. I just stumbled across it. So, um, 1989, uh, basically, um, I left the Wall Street based firm, but I started my own firm, so I went independent.

Mark: That’s got a whole story in itself, but, but basically I starved, I, I was making on average for the first two and a half years, $12,000 a year, and that was about a third of what I was making before. Mm-hmm. With the other company.

Ian and Mark: Right.

Mark: So, but it was during that time because I had refused to do cold calling and I quit the Wall Street based firm.

Mark: Um, basically I decided that you don’t make money sitting in the office. If I wasn’t gonna cold call, the only way I was gonna find clients is to get out there and interact with people. So I started investing 30 to 40 hours a week outside the office. And this was why I quit the Wall Street based firm because in 1989 I approached them and I said, you know, I’m meeting a lot of people and I’m spending all this time meeting people, but I’m not reading, meeting the right kind of [00:07:00] people.

Mark: I, I need to hang out where there are more affluent people. Mm-hmm. So I have two ideas. One is I volunteered a couple times with the United Way. I chatted with them and they wanna put me on a board of directors. Down there and would you know, is that okay with you? That I spend the time and there were insurance problems with, you know, you always have to approve things through if you do like stuff like that through the corporation.

Mark: Right. And, and then the other was the Chamber of Commerce, and that was like a $300 a year membership. Hmm. And I said, so would the company pay for the membership? So typical corporate approach, they said, we’re not paying for that. And I said, well then I’m not staying here. If I have to pay $300, I’ll just go out on my own and just join the chamber.

Mark: Yeah. Right. So that’s what I did. I went independent, 1989, but I was spending 2 20, 30 hours a week. I joined the Chamber. And the Chamber was a bunch of business owners and the United Way ended up being kind of affluent, philanthropic, local multimillionaires. [00:08:00] Hmm. That I just started being elbow to elbow.

Mark: Right. And of course I had the, you know, the morphed the MISC organizer and I, I kind of now knew how to have the conversation with these people. Just get to know ’em and Right. Start filling out the 70 questions. Seven, I think it’s 77 questions. And, um, anyway, so 1990 that started working. I stopped starving.

Mark: I broke a hundred thousand dollars income that next year. That was two and a half, really my third year. Mm-hmm. And then, you know, Iraq invaded Kuwait. We went to war and the market dropped, like, just as I was starting to acquire clients. Yeah. So now I have clients freaking out, you know, and it wasn’t just the 18% drop, it was like the 18% drop plus we’re at war, so there must be another 50% drop ahead of it.

Mark: You know, people just get into this cycle of fear. Right. Yeah. So that’s where I started realizing that affluent clients are irrational. Before that, I thought they were superheroes that walked on water. I [00:09:00] mean, they’re obviously successful, they’re doing something right. Right. But it was in, during this period, 1990, I realized that, uh, these people are nuts.

Mark: I mean, they’re just all about fear, right? And so I started doing things about that. I, and I put a little note there on the side of some of the things I did, but basically it was, I would have conversations with them about, just in theory, about how successful investors operate versus, you know, irrational, highly emotional people.

Mark: You know, and, and I kind of explained how, you know, the most successful investors, they just, they, they don’t look at it as quote unquote the market. They look at it as, you’re buying great companies, as long as they’re continuously increasing their profits. Right. You know, you’re just buying companies and you buy ’em.

Mark: And if they’re continue to be profitable, you don’t ever sell them. You just hold ’em forever. And then when the markets drop, you don’t sell ’em, you buy more. You know, this is, and I started having these conversations. It was after the decline. ’cause then the, the rebound was pretty quick. ’cause I [00:10:00] don’t know if you remember that war, but it, it was over like 24 hours or something.

Mark: Yeah, a couple of days. Yeah. And then, um. So anyway, I, I realized after the thing came up, you need to have this conversation before the decline. Right? So it’s while they’re happy and they’re not unhappy that you start having these conversations about how That’s right. The most success you try to remove emotion was basically what I was doing.

Mark: But this is when I realized that you can’t spout facts at somebody who’s fearful. So right in the middle of that war, that three month. Period. You know, I was saying all these things while it was declining, but that’s where I realized you gotta have these conversations before the decline, because this is where I came up with the metaphor for my wife.

Mark: I said, she goes, why can’t they see that, that that’s the reality? And I said, because they’re afraid. Yeah. I said, and, and just simultaneously, I had just gotten on an airplane and sat next to this, uh, woman that was terrified of flying. And I started, you know, spouting statistics about how it’s the sa, statistically the safest [00:11:00] way to travel.

Mark: And she looked at me like she was gonna punch me out. You know? I mean, it’s, and I told Peggy, I said, it’s like squirting a squirt gun on a forest fire when somebody’s actually in the middle of the emotion.

Ian: Yeah, no, yeah. If you

Mark: just start talking logic to them, it just doesn’t help.

Ian: No, it doesn’t

Mark: work. So these were kind of the dimes that dropped and it really changed things for me.

Mark: So in, and then in 1991, I read this book. It was referred to me actually, but it’s, it’s a, it’s believe it or not, a fairly well-known book in my industry. It’s called The Extraordinary Popular Delusions and The Madness of Crowds. It was written in 1841. Hmm. And it was about how politics and economic bubbles create short term like craziness in the markets that you have to ignore.

Mark: And they, and they go through. It’s really funny, if you ever read that book, they talk about the Dutch tulip mania of the 17th century. Where, right, right, right, right. Had you, have you read about that? I’ve known the story. Yeah. Anyway, so that whole thing, I, I, you know, I realized that it’s all irrational. I was kind of on this path of irrational and, [00:12:00] and all that.

Mark: So what I did, I started realizing that like Business Week Magazine mm-hmm. And Money Magazine, all these financial magazines that in their, in their, you know, attempt to sell magazines, they were putting like crazy predictions on their covers. Right. So they would put on the cover of business week, markets are at, are at all time highs, the economy is safe, you know, and then Right.

Mark: But I’d clip it. ’cause I’d, I’d know intuitively that’s a keeper. Oh, and then I went into Goodwill and I went through BA through their used books and magazines and I’d find these old magazines like this, right? And so I just created this three ring binder with like, you’d have the cover on a clear sleeve and then you’d turn it over, like it says, market’s at all time high, the economy is safe.

Mark: And then you’d flip it over and it’d say, and of course the market dropped 15% pretty much from the moment that headline came out. Yeah, exactly. And then I’d have another one, well, you know, where after a market crash it’d be, uh, like Money Magazine, will the markets ever come back? [00:13:00] Is your money safe? And then you flip it over and on the back it said, and then of course from this date, over the next 19 months, the market’s doubled.

Mark: So it was like, right. And it was like, I had a hundred of these. Yeah. And I didn’t go through it. Wrote, it was kinda like just a part of the meeting. We’d spend five minutes if, if it was in context of like, if they were fearful or something like that, I’d say, let’s pull out the book. And we’d spend five minutes just laughing about it.

Ian and Mark: Yeah.

Mark: So it was just kind of a fun little aside. That’s great. But it started making a subliminal point. And my point to people was, I, I knew that you had to come up with a kind of a more emotional way. I couldn’t throw this book from 1841 at clients and Right. Expect them to read it. Yeah. They’re not gonna it.

Mark: So, I don’t know how I came up with this, but I, that worked. So I had this three ring binder and it was subliminal and people started realizing, okay, I get it. The media’s always wrong and short term doesn’t ever mean anything and it’s, you know, so that was kind of a big breakthrough. And then there were a couple of years in there where I can’t find anything, but in [00:14:00] 1994 there was this book that I read, and it’s funny, he just this year released the fifth Edition, but it was this famous book called Stocks for the Long Run, written by Jeremy Siegel.

Mark: He’s the head of the economics department at the Horton School of Business. And, uh, basically that gave me all the stats. I mean, it was, it gave me the courage of my convictions. He went back, I think 200 years and proved that, you know, the equity markets stocks outperformed every other asset class in the long run and that the short term markets were just noise and never mattered.

Mark: Right. And, and going back as far back as history. Could take you, but I knew that you had to come up with emotional conversations about this. So I spent a lot of time starting in the, in the mid nineties, 94, 95, 96, coming up with like little stories of behavioral economics. Like I remember reading a story, which I would tell clients about.

Mark: So rather than to have them read this book, Jeremy Siegel, I [00:15:00] would say something like this. I’d say, well, they did a study, psychologists did a study, and they did this study where they had a guy with two Broadway tickets that are worth a hundred dollars each, right in their coat pocket. And then they’d hire a pickpocket to take it to steal ’em, okay?

Mark: So that when they show up at the theater, the tickets are not in their pocket. Okay? So if they lost the tickets, they would not replace them. They just, they thought, I’m not gonna spend 200 more dollars. I learned my own lesson. I’ll just not go to the play. They compared it to another study where instead of tickets they gave, they had him put $200 bills right in their pocket, and then they pickpocketed that and in the case of the money being lost instead of the tickets, they always replaced the tickets.

Mark: Like, I lost the money. Well, I’m here and I wanna see the play. I’ll just go buy the tickets. So, but it’s totally irrational because you’ve lost $200 either way.

Ian and Mark: Yeah, exactly. So

Mark: I, and I would say that, and I, and then I would make some analogy to the book and I’d say it’s, [00:16:00] it’s so funny. I mean, this, the, the, the statistics are that the equity markets have averaged 12% average annual return for over a hundred years.

Mark: And if you remove the, anyway, I would just make a little one-liner, a little factoid out of that book stocks for the long run to kind of end little stories like that one and that I just. Showed you. Right, right. And it was clumsy, but it started to see a shift in the client’s paradigm. So I started to realize that this really helped.

Mark: And as long as you did it in the, uh, it’s called countercyclical environments. Yeah. So in, in up markets, I’m preparing them for the down markets. And in the down markets, I’m preparing them for the up markets. Right. You know? Right. And so, and, and that’s what I kind of cracked the code. And that was big actually.

Mark: Mm-hmm. I’m not even sure how to tell that story, but, but that right there was a huge, I started adding a lot of clients and when the markets declined, I started keeping clients more comfortable. Right. And it was in that year that I decided, I realized that clients care more about their goals than they do the markets.

Mark: It had never occurred [00:17:00] to me. Okay. Right,

Ian and Mark: right.

Mark: Um, because I had a, my biggest client said, you know, it’s funny, we’re talking about all this ’cause I only care about whether, whether I’ll be able to retire or not. You know, so, okay, so the market drops 20%. I’m, my, my question is, okay, I understand markets go up and down, but does that mean I can’t retire now?

Mark: I mean, I, I, I was like, that was such a big breakthrough to me. Mm-hmm. I know it’s stupid, but we just weren’t trained in the, in the industry to do that. We were focused on investments and we were trained to focus on investments, and that’s what we did. Yeah. And so it led to this whole thing that I go, oh, and you know what?

Mark: Then you focus on things you can control. So if the market drops and your goal is retirement, maybe what I tell you instead of, you know, oh, the market will come back. Maybe what I tell you is, why don’t you tighten your belt and double up what you’re adding to your retirement accounts right now. And that will get you back on track to your goals.

Mark: And oh, by the way, when the markets do come back, you’re buying more stock. I mean, maybe it’ll excel. Maybe [00:18:00] you can retire five years earlier. Right? Anyway, but it was a focus on the goals, not the investments. So, and then 1995, that was a huge breakthrough because there was a, uh, software service that became available called Financial Profiles.

Mark: It was the first that I had ever heard of, of a software program that a, just an independent financial advisor like me could buy and then start creating financial plans. Uh, before that, you had to actually hire companies like American Express or Ameriprise. You could pay them, I don’t know, $500 and they’d do it, like I’d, I’d send them somewhere else to get their financial plans, which was not good ’cause they’d always try to sell ’em investments and stuff.

Mark: So I bought this software and that was after I figured out clients care more about their goals. Well, now I was full on, I was creating financial plans focused on the goals. So it was 1995, that whole shift occurred. I, we, I started doing financial plans. And so 1996, um, a couple things happened. One was I [00:19:00] realized that it was taking me like three to four hours to create each one of these financial plans.

Mark: So every time a client came in, I had to spend three or four hours. And then as along the way when I had questions like, oh, this client has a pension from the phone company. How do I enter that into the software? They had a phone number to their support line. And they had a certified financial planner on the other end to tell you how to do it.

Mark: And there was the head of that department and he had three others in the department. So you might get any of the, the three of them. But I kind of took a liking to the head of the department. He seemed more, more knowledgeable. His history was, he had come from American Express, that’s all he did was financial plans over to at where they used to do them.

Mark: And um, now he worked for this company. So in 1996, in one of the calls, it was so serendipitous. I was so frustrated that it was taking me so long to do these things that I just, I just said, um, you’re better at this than I am. Why am I even doing [00:20:00] this? You do this. I mean, you obviously like, it takes me three to four hours.

Mark: It sounds like it take you about an hour. And he goes, I don’t know. Nobody’s ever done that. Let me think about it. Anyway, so we cut a deal and he was in Los Angeles, I was in San Antonio, Texas. I would box up all the clients, I’d copy everything. Right. And I’d get the client to sign off that I could show their stuff to this financial planner that I’d hired and I would, I would FedEx it to his home.

Mark: He would take it into work and after work it would take him about an hour and a half and he’d create the financial plan and then he would, uh, send it back to me on a one. Are those five and a quarter inch floppy? I mean, you’d laugh on how the whole thing worked. I mean, it was just so low tech now. But it was funny and, and, but it was kind of slick ’cause he would just send me the file and then he had to teach me.

Mark: ’cause it wasn’t like normal to do it this way. He had to show me how to upload the file into the software. ’cause that’s not, I mean, the software was designed to just enter all the stuff, you know. [00:21:00] But there was a way to do it. And he, but he kind of had to show me how to, you know, see colon back slash So anyway, that worked for, I’m gonna say three or four years.

Mark: I mean, that was, and that was a big, huge thing for me where I realized that there are people out there who are more skilled than me. Why am I doing any of this? So he was my financial planning subject matter expert. He was my first subject matter expert. That was 19 96, 19 97. Uh, the problem was with financial profiles that, oh, and he would FedEx back the plan.

Mark: So it was this five pounds of paper. With all these charts and graphs and, you know, lecture and lessons, you know, like, oh, you know, trying to educate the client about their own situation. And again, one of my, I think it was my very top client, it might’ve been one of my top two, but I think it was my top client, uh, complained about going through this financial plan.

Mark: I mean, it was so huge. And then he was so [00:22:00] worked up about it. He said, oh, by the way, I also hate the investment statements your company sends. I mean, he was on a roll. So I laughed and I said, okay, let’s stop the meeting. So you tell me what do you wanna see? That was probably the biggest question I could have asked.

Mark: You know, what, what do you wanna see? What do you need to see? What’s most important to you? So I realized in financial profiles that of those five pounds of paper, there were five pages that were kinda one page graphics. And I, so I told my guy, I said, I just want those five pages in color. ’cause he was, oh, I don’t know if you remember printing in color back in those days.

Mark: I mean, that was just such, you had to, had to have, what was it, a plotter, I think it was a plot. I think it was called a plotter. Yeah. So I, I said just do those five pages with the plotter and then everything else just print out dot matrix. I just need it for backup. I just wanna see the schedules and everything.[00:23:00]

Mark: And so he said, okay. So that was it. But it was in that process while I was talking to the client that I created the circle chart. Okay. And that was huge. I mean that, that started in my mind, I was thinking, clients just need certain information to have these conversations with me. So they, number one, feel updated.

Mark: And number two, they have enough information in their head to make decisions so they don’t feel like they’re blind, you know?

Mark: And they like graphics. That was the other thing I discovered. Yeah, I mean like infographic type format. So, and then 1998, um, that was the year that the dime dropped for me. I, I had acquired three clients kind of in rapid succession. Like, like for the first time in my whole career I had three kind of big clients, like one right after another.

Mark: I think two joined in the same month and one joined the next month. It was like in a two or three month period, I had three multi-millionaires. It was really, really [00:24:00] big. And now I had 17 multi-millionaires total. So, but, but it was clear that these multi-millionaires, when I acquired these three, it was something about the dynamic of them coming on all at once.

Mark: That you kind of create a process. ’cause you, you, you’re having kind of the same conversation three times and Yeah. And, and then, and I started kind of getting better at it. So by the third guy, I, you know, I, it was. A lot better. But what it uncovered was these people don’t have a strategy. So it was still this kind of peeling away the layers of the onion, just completely not realizing that these affluent people are irrational and disorganized.

Mark: I mean, I did not have a clue. I thought they were all like bulletproof. So this is where I realized, so I went back to all 17. I, I, I figured, okay, so this is true for the three that I’m getting now. Let me go back to the others. So there were a total of 17. And, uh, so I [00:25:00] went back to the others and they all confirmed that none of them had a strategy in place before we created their financial profile, financial plan.

Mark: I went back and I, you know, I said, so we, we did this. But, so in the before that, how did you measure success? How did you hold people accountable? And it became clear they had tacticians, but no strategists. Nobody was doing this. I was the first time that anybody had, I was the first one that had ever suggested, let’s create an overarching strategy.

Mark: And, and, and the how do you measure success? Question was the big one. Like, uh, ’cause okay, so then the dilemma was that same year I was thinking, okay, so I know the situation now, the dime has dropped. I, these multimillionaires have no plan, which is kind of ironic ’cause most of them were business owners and had very good business plans.

Mark: But on their personal side, you know, it was total shambles.

Mark: Yeah. So the [00:26:00] first dime dropping was the realization that they, they didn’t have a strategist, but the second dime that dropped was, you can’t just sit down with a potential client that’s kind of assessing whether they wanna work with you or not, and you just say, Hey, you can’t alert them to the problem in a way that makes ’em feel like an idiot.

Mark: Right. So that’s the other thing about these multimillionaires that I’d learned about is they kind of have fragile egos. They’re very disorganized, they’re irrational. But if you insinuate anything along those lines, it’s not gonna help. It’s gonna shut ’em down. So I created this. Yeah. So I put here the note.

Mark: I created a safe environment for potential clients to discover for themselves that they had no strategy in place, and that their existing team is made up entirely of tacticians. Basically, I just asked a se, I worked out and finally figured out a series of questions. Yeah. Anyway, [00:27:00] so it’s, you know, how do you measure success and is your comprehend, you know, what are your goals?

Mark: Hmm. I don’t know. And, and do you and your spouse agree on these goals and just all the things that would be the earmarks of a plan. I kind of reverse engineered our financial plans and they discovered, and then, and then the skill was in bailing out on the questions, right? When you kind of discover, oh, I get it.

Mark: You don’t have a strategy, but you’re trying to be diplomatic and polite, so you kind of stop. Right, and, and then you, the skill is to just to to, to misdirect and to say, you know, rather than go through these questions, why don’t I propose this? I think the first thing we should do is sit down with you and your spouse and let, why don’t we do this?

Mark: Let’s just make the first thing we do, create a comprehensive, written lifetime financial strategy, something that will allow us to hold your whole team accountable. Sounds like they’re very good at what they do, but they’re just tacticians. They need to know the overarching strategy. Let’s create that for them.

Mark: Then we’ll have something to hold ’em accountable against, and we can measure [00:28:00] success to make sure you’re making progress. Oh, that makes perfect sense. Why don’t we do that? Thank God you’re not gonna ask me if I’m an idiot. You know? So that took a long time to kind of work out how to do it in a way that was kind of disarming.

Mark: I mean, also don’t forget, I had read non-manipulative selling, so I was all over not being manipulative either. You know, you had to kind of strike the balance, but I thought of it as kind of, um, what, what would you call it, etiquette, where you’re, you’re trying to let them come to a decision that’s critical without.

Mark: You know, shutting them down. So it’s just a way of handling people. And then the final thing in 1998, the other thing that I realized was that in doing these financial plans, so I started realizing that certain clients really do value this comprehensive financial services, the fact that you’re looking at everything.

Mark: So in financial profiles, you entered information about their wills and trusts, you entered information about their things. [00:29:00] I had never asked for auto insurance, homeowners insurance, just to send all the stuff to my guy in California. I had to ask him for copies, things I had never asked for before. Tax returns, auto insurance, homeowners insurance, wills and trusts, all these things that I had never cared about before.

Mark: And, and it was kind of interesting. I realized certain clients really valued that, but not all. And I realized that just asking them for the documents made them happy. Would say things, some of them would say things like, oh, thank God nobody’s ever even asked me to look at my home insurance before. I really appreciate your looking at that.

Mark: So I realized that it was kind of ironic. Nobody was doing this. Certain clients really valued this a lot, but I felt guilt because on the backend, I really wasn’t doing anything with it. I, I was asking them, and we were creating files. So now we were creating tax files and we had their wills and trusts.

Mark: But I mean, it just sat there. It’s not like we had anybody looking at it. [00:30:00] Well, I mean, the stupid software asked for you to input something and we were just asking for it and we didn’t do anything with it. So that kind of bothered me. Okay. So we’ve covered all the things that went into building my business from 1981 up till 1998.

Mark: And for 18 years, I’d figured out a lot of things, but the one thing that I had not figured out was how to be happy. I was not. Making a difference in my client’s lives. I remember entering the year 1999 with very depressing prospects. I hated my business. I was spending 80 hours a week running the business, so I was ruining my family life.

Mark: I had almost no personal life, and I had 1,242 clients. And for those clients I was not making any difference in their life. I wasn’t particularly adding any value. I couldn’t even meet with them on an annual basis.

Ian: That’s barely an hour. You can barely spend an hour per client.

Mark: Yeah, yeah, [00:31:00] yeah, exactly. So 1999 was very, very depressing as I entered into the year and the first thing that happened, and this is every year, I was the number one producer at our broker dealer firm.

Mark: So very, very soon. After every new year, we, we always got a little form from our broker dealer inviting us to the national conference. Well, the national conference was usually in the summertime, and they started pressing you in January and February to, to let them know whether you were gonna attend or not.

Mark: So they pressed me to attend and I, I said, no. I sent in the form and I just checked the no box and said I wouldn’t wouldn’t be attending. And then the next thing that happened was I, the next thing I knew, I had a phone call set up with the chairman of the board of the broker dealer firm who was really twisting my arm.

Mark: He was saying basically two things. You’re the number one producer and you have no idea how inspiring it is for other advisors to, to meet with [00:32:00] you and hear what you’re doing, and you know you can make a difference in their lives. And he said, uh, that he promised me that he had put together a curriculum at this particular national conference that would actually be worth my time.

Mark: So I was very doubtful, but I relented and I decided I would go. So I went and then, uh, he was right, 1999, ended up being the big catalyst that pulled together all these things that I had had been establishing in my business that worked very well over the past 18 years. And the Catalyst was a speaker that was scheduled on the agenda, somebody who was actually quite famous in the industry, but I had never heard of him.

Mark: And his name was Bill Backrack. So Bill was the keynote speaker at their conference that year. And I remember hearing him talk and he, he was talking about a, uh, process that he had developed, a methodology that [00:33:00] he called values-based. Financial planning. So I had already been doing financial plans for my clients.

Mark: That was one thing that, that I did that most of the other advisors in our broker dealer firm did not do. And that was create a financial plan for, for all my top clients and with financial planning in those days. And I think to this day, the way you’re taught to establish, uh, to begin working on a financial plan for a client is to start by establishing what their goals are.

Mark: So you sit down with a client, you ask ’em, you know, so what are your goals? And Bill turned that upside down. He said, no. Um, the way you do it is in his methodology. If you can get a client focused on their values first, the things in their life that matter more than money, then. There’s an opportunity for them to then make a connection between their values and their goals.

Ian: Yeah. Sets a context for the goals. Yeah. Yeah.

Mark: That it’s, [00:34:00] it’s, it’s the why creates a

Ian: motivation. Why. Yeah.

Mark: It’s the why behind the goals. Yeah. Yeah. And so this was revolutionary to me, but that all, that was interesting. But the main thing that I got out of it that really changed everything for me was his whole idea of having a relationship like that, a deeper relationship with your clients, focused on their values.

Mark: That, uh, was where you, you would take all the financial affairs off the client’s hands. With the idea that you’re creating more time for them to go out and explore and experience their values. So the, the change in the relationship was, rather than the financial services that we were providing, being the most valuable thing that we held out to the client as, as what we do, it was the creation of time for them was, was the, the big deliverable.

Mark: And that if you have the right client who cares about their values, has some [00:35:00] things in their life more important than money, that uh, it set up a different kind of business where you, you did a whole lot more for a whole lot fewer clients. That was the bottom line. And I just remember being blown away. I was saying, thinking that’s the catalyst that that is, that I’m missing here.

Mark: Yeah, that was the thought. Yeah. So that was a big breakthrough for me. I remember leaving the conference and thinking about it. I couldn’t shake the idea out of my head. I read his book. He, he had a tool called The Financial Roadmap. So I started doing financial roadmaps for clients. I was very rough at that, but basically I went to, uh, I, I actually then flew out to an academy of his and got better at this, uh, technique.

Mark: And in essence, I realized somewhere along the line between June and the end of the year of 1999, that this is what was missing in my business, that I had figured out so much. I was, I had worked out a non-manipulative, uh, approach with clients. So I [00:36:00] had eliminated selling as, as a way of acquiring clients.

Mark: I had figured out how to acquire, how to establish relationships with affluent people. I had figured out that surprising to me. Affluent clients were very, actually very irrational in their financial decisions. So I, I had figured out so many things, but what was missing was a kind of a focal point, a product as it were, something that I could focus all these disparate skills around, and it became this financial roadmap.

Mark: I realized that as I was interacting and developing relationship with lots and lots of affluent clients, that just talking about the idea of focusing on values and offering to sit down and rather than talk about investments or finances. You know, let’s sit down and create your financial roadmap and let’s help you connect your values to your goals and, and leave with a roadmap so you can, in essence, uh, have, have a plan in place or, or a, a [00:37:00] kind of a blueprint in place, uh, that helps you accomplish all your financial objectives.

Mark: And that was the catalyst that was missing, right? Something that I could talk to affluent people about that had kind of a business purpose. So you’re being a nice person. You’re, you’re making friends with lots of affluent people and I had a lot of people in my circle of friends. Yeah, but when the conversation always turned around to, so, mark, how’s your business or what’s going on in your business?

Mark: I, I would just always kind of give superficial answers with no particular direction. Well, now I could say business is doing great. As a matter of fact, we’re, we’ve implemented, uh, this new thing, values-based financial planning, you ought to, I’d be happy to sit down and complete your financial roadmap. It put, it put kind of a focus to these relationships that I had, and I started doing a lot.

Mark: I started meeting, I, you know, I tripled my rate of meeting with new potential clients just by this catalyst, having this thing [00:38:00] to accomplish with potential clients. And so this was, I realized in 1999, towards the end of the year, that if I really wanted to jump in the river and, and, and perfect my skill with this initial client interview, that that would be the dividing line in my career.

Mark: And, and I was so miserable. In the business that, that, I remember thinking in November and December of 1999 that I kept waffling, do I join bill’s, you know, elite, high-end, expensive coaching program for the year 2000. It started in January, either two. That, and completely transformed my business. Or I finally decided I have to, I have to give this a shot because the alternative is I’m ready to quit this business.

Mark: I am so miserable. So I jumped in the river. I, I joined his coaching program and, uh, made it my goal in the year 2000 to, uh, completely [00:39:00] transform my business 100%. So. I started off, I just kind of went through the process. I already had the non-manipulative selling approach, so I didn’t use sales, but to increase my client base, I needed to have an ideal client profile.

Mark: In other words, if I was gonna look for fit, I had to have criteria, right? Like what is the fit? So I sat down and established an ideal client profile, and in the process of doing that, I realized, you know, I don’t even know how many clients I can handle. So I went through a whole big exercise doing that, how many hours do I wanna work in a year, and how many maximum clients do I want to have?

Mark: And I figured out that was a hundred, that if I had a hundred clients, uh, I didn’t know how much I’d charge them, but at the end of the day, I could handle a hundred clients and still have plenty of time off. You know, time of my own, you know, working 40 hours or less a week. [00:40:00] So that became the number, but then I was still stuck.

Mark: I didn’t know what to charge clients. Well, that situation got taken off my hands a little bit. I had the, I had this unfortunate situation in the first quarter of 2000 where a, a very loyal client of mine had a big tax surprise because he took my advice just a couple of months before and sold a bunch of investments, which was a very good move actually.

Mark: But it triggered $30,000 of taxes. And, uh, that wasn’t such a big deal except for the fact that it was a surprise. I hadn’t figured that out, or we hadn’t told him. Anyway, he was just really shocked when his accountant told him, you’re gonna have to write a $30,000 check. So he came to me pounding the desk, and he was threatening to quit.

Mark: And he was this, we’re talking about a loyal client who had referred a lot of. Right people. And I was shaken. I was thinking, well, this can never happen again. And I remember thinking, I don’t know exactly what to do about this. So, so I shared the problem. I happened to be at one of the [00:41:00] coaching sessions with Bill, and I was talking to him about it, and he said, why don’t you just, he goes, mark, there’s lots of really skilled professionals out there.

Mark: Why don’t you just go hire an accountant to do that for all your clients, like to sit down and make sure all of their tax taxes are in good shape. And I’m like, duh, that was, that’s a great idea. So I, I went out and I, I actually had another problem with another client on an estate planning issue. Where they were very, um, well we were kind of confused as to how to set up the, uh, naming on one of their accounts ’cause their estate plan wasn’t clear.

Mark: So I thought, okay, I’ll, I’ll do two at once. I’ll go out and find a really, like the best accountant in town and I’ll get the best estate planning lawyer in town, and then I’ll just pay them a small fee to, uh, to do this for all my clients, just to run through all the situations. Right. You know, and, and to make sure estate planning and taxes were in great shape.

Mark: Right. [00:42:00] Well, that was perfect. And even with the client that got upset, he, he was not happy about the surprise, but, but I did make the point to him that he made something like a hundred thousand dollars on the sale, so, you know, okay. So I didn’t want him to hold back 30,000 of the hundred, but I mean, come on now.

Mark: You made a lot of money here. And so he, he got over it and, and, and the only way he got over it, Ian, I figured it out and I think it’s human nature with all of us. I convinced him that it would never happen again. I think the only answer that really works with people when something goes wrong, if, if you do something wrong is, number one, take responsibility.

Mark: Like, don’t waffle. Just take the hit, say I was wrong, and then promise it’ll never happen again. And then, and then you’ve got to live up to that. You’ve gotta have a process in place to make sure that never happens again. So I felt like I had that, but the point was now I had two subject matter experts that are on my payroll.

Mark: So I had an assistant, [00:43:00] I had a couple of clerks, uh, working for me, uh, on the money management side. I had two people supporting that. And then I had these two subject matter experts. I mean, I had quite a few people on my staff at this point. And I was obsessed with covering all these costs. So when it came down to, okay, I know I’m gonna have a hundred clients, but I don’t know what to charge them, I kept obsessing on this.

Mark: I’ve gotta cover all these costs. And then I guess what I thought was, I’ll just mark it up enough to make a reasonable profit. It was just a little bit arbitrary, and so I did, so I established a fee. It was $10,000. I figured if I had a hundred clients paying me 10,000 each, I’d probably be doing okay.

Mark: I’d cover my costs, have a little bit reasonable profit. The positive was is, is it a stab? It established a stable fee. It eliminated commissions. Prior to this year, I basically just charged commissions. [00:44:00] So I was the number one producer at our broker dealer firm by sitting down with affluent people, uh, figuring out what their investment pro portfolio should look like to be suitable for them in their situation.

Mark: And then whatever the investments cost to put that portfolio in place. I just charged commissions. And the, the downside of that is every year you start it over, you know, you, you had to go out and do it again every year. So that got old. And this, the positive part of this was by charging clients $10,000 every year, kind of a minimum of $10,000.

Mark: That covered the cost and it established a stable fee. Uh, there was a minimum. It was recurring. It was an annually recurring revenue.

Ian: And they knew what they were gonna be paying.

Mark: That’s it. And that was different at the time. The negative was I later came to realize that clients were actually willing to pay more.

Mark: It was kind of a funny, I had a lot of clues on this. When I established the ideal [00:45:00] client profile, I applied it against my client base. So I had 1,242 clients, and I was very frustrated to find that after 18 years in the business, when I applied that ideal client profile against all these 1,242 existing clients, there were only 17 who met the ideal client profile.

Mark: So I realized. I’m starting over. I mean, this is very frustrating. So I had these 17 ideal clients and the clue that I had, that I had mispriced myself was when I sat down with those 17 ideal clients and, and made the offer, I said, Hey, I’ve got this new way of doing business and the old way of doing business, I charge you commissions every time you needed an investment in the new environment.

Mark: It’s an annual fee and it is 10,000, but here’s all the things we’re doing and we’ve got the tax expert, we’ve got the estate planning expert. I’m creating a financial plan and we’re gonna keep that current. And everybody said yes so fast. They [00:46:00] just say, yes. I didn’t even finish, get it outta my mouth, what we were doing for them.

Mark: And every single one of ’em, all 17, said yes with no delay. Nobody said, let me think about it. And I just remember thinking, I’ve screwed this up somehow. Everybody said yes, way too fast. But anyway, that, that got done in 1999. So, or, or sorry, in the year 2000, I got all that figured out. The other thing I figured out was that I realized I couldn’t do it all.

Mark: Uh, that was a, believe it or not, that was a big realization for me. So, you know, I had the tax and estate planning and then I started thinking about the things I was doing. So what was I doing? I was actually creating the financial plans and managing the money. So I had a tax expert and an estate planning expert, and then I had me as the money management expert and the financial planner.

Mark: And I sat there and I looked at [00:47:00] those two subject matter experts and I thought, they are so brilliant. They are so skilled. They’ve been doing this even longer than me. I had been in the business 18 years doing whatever the heck you would say I’d been doing all these years. Let’s just loosely call it money management.

Mark: But they were so much better at their little narrow fields of finance than I felt I was at Money Management, and I just remember thinking, there’s gotta be people out there I know there are, who are just so much better at financial planning and so much better at money management than I am. And then it, it didn’t, it wasn’t lost on me in that I wasn’t convinced I could scale the business.

Mark: I, I knew I could do it with 17 clients, but I started to worry about what about when I have a hundred, a hundred clients? You know, because I knew how much it took to do all this, you know, to, to manage the money and do the financial planning. And I just remember thinking, this [00:48:00] isn’t my job. You know, my job, I, I decided kind of the 80 20 rule.

Mark: I decided that I should be investing 80% of my time either face to face, serving these ideal clients. They’re paying me all this money, they’re putting all this trust in me and I should be interacting with them most of the time. And if not them, I should be out finding new clients. I should be, you know, these are the two things in the business that I felt that only I could do.

Mark: I could, I’m the only one that can sit down face to face with the clients and serve them. I mean, I’m the one they trust. And then I’m the only one that can go out and find new clients. So I started kind of multi doing a little multiplication thinking, what about all this money management and financial planning?

Mark: So I made the decision that I couldn’t do it all that the trust and in fact the trust, I decided the trusted advisor shouldn’t be doing any of this. That there are all people there, there are all kinds of people that are [00:49:00] far better at all this, and, and they’re all over the place. I, I, I just was convinced in finding the tax and estate planning person that, that they’re, they’re skilled people everywhere.

Mark: I just had to go out and acquire them. So basically. That’s a big decision that I made in 2000 that, um, that I would go a team approach. That I was not gonna be a one man band doing everything. And I was so concerned about the cost of everything. I, I just figured, okay, so I’m gonna find a financial planner, a money manager, I’m gonna replace all these positions, right?

Mark: I’m not gonna do anything, but I’m gonna build this team on a zero budget. I’m gonna go out and I’m gonna expl, I’m gonna find skilled subject matter experts, and I’m gonna pay them with the client’s money. I’m gonna tell them I’d like you to join my team, but I’m not paying you until we acquire our next ideal client.

Mark: So it kind of set a precedent for the way to do this. You know, you don’t be a one man band and you build a team and [00:50:00] you, you build the team on a zero budget. That was a big breakthrough in the year 2000. Mm-hmm. And it solved a big problem. So at the end of the year, 2000, Ian, the. Program with Bill ended, I mean, December of that year, it was a one year program.

Mark: It was over. Yep. And I was making so much progress and I was accomplishing so many things. I was adding ideal clients very, uh, at a very nice clip. I was solving problems as far as, um, you know, serving the clients, like, how do you actually deliver to serving these clients? And I decided that I don’t think I can do this alone.

Mark: And, um, and basically, uh, I realized that I needed accountability. So it turns out Bill rack’s wife and brack. Had a coaching business on the side. She was an accountability coach. And so I hired her and, uh, that was a big breakthrough for me. So at the end of 2000 at, at the end of the Trusted [00:51:00] Advisor coach program, I ended that program.

Mark: But I started with an accountability coach just to keep me on track. And now what she did, which was a little bit different than what Bill had done, she had me actually sit down and quantify all these goals. I knew I wanted a hundred clients, uh, and I knew what I was gonna charge them, at least at the moment.

Mark: But, but I didn’t have a target date set for that. And so, so I set the target date. She had me set a goal. My goal was to, to basically acquire a hundred ideal clients by December 31st, 2002. And that even further surprising to her, I wanted to sell my business by December 31st, 2007. I was all focused on, um, the big macro economic picture where you had all the baby boomers coming into retirement age, and I, I was kind of convinced that the markets would get unstable or at least everything would change in the business, and I’d rather just [00:52:00] monetize my business and get out.

Mark: And so I set all these goals and, and so by having an accountability coach, she had me really sit down and figure out, okay, if you’re gonna accomplish those goals, she had me break it down and figure out, well, what do you have to do week by week to accomplish those goals? So I entered 2001, and the, the big thing that happened in 2001 was I was making so much progress providing value.

Mark: To my ideal clients and mm-hmm. That, that I decided, you know, especially those original 17 clients, they were so helpful to me and they were so wise. I I, I got the idea that what if I gathered them as a group and just, you know, what they call today, today, they would call this a client advisory board, but they didn’t have any model for this.

Mark: So I called it a focus group. Right. And, and I had it in my head, this whole idea that every client said yes a little too [00:53:00] quickly to the $10,000. And I got to thinking, what if I got them together and cut them a deal? What if I promised to grandfather their fee and not change it if they would just be honest with me and tell me what clients would be willing to pay.

Mark: And oh, by the way, what else? Do clients want, like really become an advisory board. So that’s what happened. And I’m telling you that focus group told me everything I needed to know to create the business that, uh, transformed everything.

Ian: That’s actually brilliant. I mean, have them coach you on how to serve them.

Ian: That’s brilliant. Right,

Mark: and they, they were older, most of them. Yeah. Lots of retire, lots of experience. Yeah. Very, very, very highly successful high-end business people. And so a lot of things came outta that. One of them was they, they complained at the very first meeting. They complained about the fact that I wasn’t meeting with them at a regular frequency.

Mark: And they said, you’ve got to fix that. [00:54:00] So I tested that for that whole year of two, 2001. Uh, I had, on the one hand I had my subject matter experts who actually had lots of things. They needed information and documents that they needed access to the client. They needed interaction with the client to get what they needed to do their work.

Mark: So you had that on that end. And then you had the client who definitely wants to be updated. You know, yes, they’re delegating their financial affairs, but they want, they don’t wanna feel like they’re losing control. And so, you know, they, they wanted to meet at a certain frequency. So I was trying to play around and figure out what’s the perfect balance.

Mark: ’cause I realized that with this new financial arrangement, that, that, that, that the value was time. That what I was trying to do is create time for my clients. That what that really meant was I wanted to create a, a meeting process that was the least number of meetings necessary. That [00:55:00] accomplished the results my team needed, in other words.

Mark: Right. I realized my clients would rather be with somebody other than me, right. In their free time.

Ian and Mark: Yeah.

Mark: So, you know, we tried four meetings a year. That was too many. Uh, I switched, uh, to a six month cycle where we were meeting semi-annually. That was not enough for my team. Long story short, we just ended up perfect.

Mark: Uh, kind of Goldilocks two hot, two cold three meetings was just right. And so we created the three meeting process. So that came out of 2001. There were a lot of side benefits to that, not the least of which is now that you had a three meeting process, that means you’re meeting with every client three times a year.

Mark: You’re meeting with every client every four months. That’s set up an arrangement where you could make up check a series of checklists. It, it allowed me to create a checklist driven process. To deliver comprehensive financial services. And then the other thing that happened [00:56:00] in the focus group was they complained about the content.

Mark: So they, they were bitching and moaning about how, you know, when we come in, mark, you’re just talking about the markets, you’re talking about performance. I mean, they get the feeling they were, it was just, uh, I was very embarrassed. They were saying, you know, my and my spouse hates coming into these meetings.

Mark: ’cause it doesn’t, they don’t feel like they needed to be there. Anyway, I began as a result of these focus groups improving the content of the meetings. And it was in 2001 that I just implemented. Two simple changes based on the suggestions of my focus group. Now keep in mind at this point, I had double that number of clients, but they weren’t on my focus group.

Mark: So I was able to. Implement some ideas from the focus group and then go kind of test it with the non focus group people and see if it made a difference if they, they enjoyed it or if you know, if it, if it, or if they, if it increased referrals. That was really the way I was measuring it. If, if, if all these ideas are so great, then, then, then they won’t be able to resist referring me to people.

Mark: Well, [00:57:00] that happened. Uh, the two changes were that one, one was very simple. They just suggested Mark can, can’t you just think in advance about what the biggest issue is? In other words, how about only bring us in when there’s like a high priority issue to actually discuss, you know, let’s not meet if there’s nothing to talk about.

Mark: So I implemented a process where we resolved to begin planning and thinking way in advance internally about what is the biggest issue for this client. And I made it the subject matter expert’s job. I told the tax and the estate planning, uh, subject matter expert. Uh, I want you to tell me, well in advance of the meeting, what you think the biggest issue is for this client.

Mark: So all it was was just some advanced thought, a little bit of internal discussion. And, and so we, we just made sure when every client came in, we had a top priority issue to discuss. As simple as it sounds, that made a big difference. ’cause now we had a, a reason to [00:58:00] meet. The second thing that I in innovated was.

Mark: It, it was not clear to every client whether they were on track or not. And I, that stunned me. I couldn’t believe in the focus group to hear client after client say, agreeing with each other. ’cause they were saying, how about you? Did you know in the last meeting whether you were on track or not? And client by client, they kept saying no.

Mark: Uh, he never said we’re on track. He just talked about the markets and the performance. And I, so it occurred to me that it was critical to make sure that every client walked out of every meeting knowing that they’re on track or alternately if they’re off track on something to provide recommendations in that meeting for getting back on track.

Mark: So that’s, those are the only two changes I made. I, I give some advanced thought to what is the biggest issue, and we started making some progress on those so that we had something to recommend in the meeting. And the second thing was that we made sure that every client knows that they’re on track and not just with their goals.

Mark: But with their cash [00:59:00] reserves, their debt. So we would just say, you know, you’re on track with your cash and here’s why. You’re on debt. You’re on track with reducing your debt. Here’s why. And you’re on track to your goals, and here’s how and why that made a big difference. So I had a lot more improvements to come.

Mark: I knew in my head that we were just starting to scratch the surface of things that we could be doing to improve the client experience. But my ideal clients told me that just these two additions, uh, to every meeting vastly improved the, the quality of the conversations that we had during the meetings.

Mark: And my clients that were not on the focus group confirmed all this. They just, they, they noticed the change and commented about it in large numbers. Our and our referral rates went up.

Ian: Wonderful.

Mark: So, and then finally in 2001, I perfected my client acquisition process. Uh, by the end of 2001, I was acquiring more than one new ideal client every single month.

Mark: Things were really coming [01:00:00] together. This whole idea of basically be being out there in the world and talking about completing your financial roadmap, that was working. The idea on the backend where we were doing so much more for clients on the backend, that they, the referral rates were rising and my community of non-ideal clients was getting smaller.

Mark: Don’t forget, I had 1,242 clients. Only 17 ideal clients. That meant I had 1,225 non-ideal clients. So I came up with this, this idea that every time I added a new ideal client, I would get rid of some number of non-ideal clients to capture whatever revenue was being brought in by the new, by the new ideal client.

Mark: And so I was politely disengaging in referring to other advisors, lots of non-ideal clients. So as I was growing my ideal client community, I was reducing my non-ideal client community. And I was happier. I, I was noticeably [01:01:00] happier by the end of 2001. And um, and this was really the first time at the end of 2001, that I started hearing clients tell me in lots of these meetings that we were having with them.

Mark: This was the first time in my career that most clients were confirming that they were receiving true value from the work that, that my I and my team were doing for them, and we were actually making a difference in their lives. I’ll never forget that was 2001 and that was a big deal.

Ian: That’s wonderful.

Mark: So then 2002, uh, in the first quarter, uh, sat down with my focus group and it occurred to me that in the financial roadmap, that initial meeting with potential clients, that that was all scripted out.

Mark: Bill had, um, created that whole meeting process and it was all scripted, except it was a point in the meeting when you would turn to the client and you would say, so we’ve come to the [01:02:00] point in our time together where you get to decide whether you wanna hire me to create this strategy, this financial strategy for you.

Mark: And then you would just be quiet. And I noticed something that they never said. Yes, they were, they were very impressed with the, the meeting. It was a compelling experience, but nobody just said yes. They had questions. And, and Ian, it was the most basic of questions. Like, for example, they might say, well, I love this, but what does it cost?

Mark: So I realized that there were just all these basic questions that clients had. So I went back and I pulled and, and I, and one of the things that I, I did not mention was, and it was a requirement of Bill Backrack in his program, he, he required that we record all these meetings. So back in those days, it was a cassette recorder.

Mark: I had a cassette recorder on the table at every client meeting, every potential client meeting, every meeting. And I would [01:03:00] disclose to the client that we would be recording the meeting or the potential client. And so I had all these cassettes, like boxes of them. Of meetings. And so I pulled 200 initial client interview recordings and I had my administrative manager fast forward the cassette to that point in the meeting where I said, we’ve come, come to the point in our time together where you get to decide whether you wanna hire me to create this financial strategy.

Mark: And she would fast forward it to that point, and I would just listen to the questions that came and some themes developed. It was, it, it was very consistent. They wanted to know things like what does it cost and exactly what do I get for the money that I’m paying you and, uh, what makes you think I’d be a good client?

Mark: And anyway, it was in 2002 that I turned that part of the meeting into a script. It became what I came to call the 10 pivotal questions. So that was a big. Thing for me, I figured out [01:04:00] here are the things that clients actually have to know before they do business with me. And I was able to sit down and work with my focus group to let them describe Mark, here’s what you actually do for us in those areas.

Mark: And so my clients answered the questions for me, and I created, in essence, compelling, concise, coherent responses to these 10 things. And it was a paradigm to me. It was in the that process of creating the 10 pivotal questions and the responses to those that I had a big breakthrough in my thinking. And I confirmed it with my focus group and I said, you know, it seems to me that we’re the only firm in town that does any of this stuff.

Mark: I mean, and you know, as I’m listening to these recordings and I’m hearing the questions kind of embedded in the questions or complaints and with some of these people, like, here’s some things that they don’t like about previous financial advisors. Right. Or they don’t like about the [01:05:00] financial services industry.

Mark: Like Right. You know, I don’t like the fact that we don’t meet regularly and I don’t, like, with my past advisors that, you know, they didn’t tell me that I was, that we’re on track or whatever it was, they would do all these complaints and it, and it occurred to me, and I, I, I asked my focus group, you know, are, aren’t we the only firm in town that does all this stuff?

Mark: Like when you go through these 10 pivotal questions and you explain all these things that we do in response to their questions. Aren’t we the only game in town? That was a huge breakthrough to me, and that really accelerated my client acquisition results. And they

Ian: obviously agreed. Yeah,

Mark: they agreed. Yeah.

Mark: They said, absolutely, mark, it’s not a choice for anyone anymore of you and some other two or three advisors in town. It’s either you or nobody. There’s nobody in town doing all this stuff. Nobody. And so I realized if I changed my mindset going into initial client meetings, that that would change everything.

Mark: That, um, that basically, um, I would [01:06:00] look at a potential client and, and, uh, complete their financial roadmap and I’d be completely ambivalent as to the outcome. I was not gonna sell them on the idea of becoming an ideal client. I was definitely, my goal was to figure out. If they met the ideal client profile or not.

Mark: Right. And, and if they did, then I, I would invite them into the ideal client community. But many people said, yeah, mark, I understand now what you do, but I’ve already got somebody doing all that stuff. And, and this paradigm shift allowed me to challenge that and say, well, I, look, I would never say anything bad about what your current advisors are doing.

Mark: I don’t even know what they’re doing. All I can tell you is this, whatever they’re doing, it’s not what we’re doing. ’cause we are the only game in town. And it allowed me to figure out something else. My focus group. Started working on a little project, I had asked them, what do you really value about what we do?

Mark: And, and, and they [01:07:00] switched as they often do. They switched the exercise around, they changed it into a conversation about how it made them feel. What were the things that I did or my team did that made them happy to pay the fee and made them sleep better at night. So, so it was kind of like they changed the exercise around That’s, yeah.

Mark: But it turned into something that, that we came to call the three client, bottom line client outcomes. So I recognized that there were three things that we did for clients that were required in order to have an extraordinary client experience. It became questions in the initial client interview. So, so I would ask a client based on my focus group saying, these are the three bottom line client outcomes that are, you know, that are required for us to feel, mark, that you’re worth every penny.

Mark: I, I would, I would turn ’em into questions. I would ask a potential client that fit the profile, I would say. So, what’s it worth to you to know that you’re always on track? What’s it worth to you to know [01:08:00] that, that their process is so proactive that you’ll never miss a financial opportunity and nothing will ever blow up financially?

Mark: And the third one was, what would it be worth to you to know that you’re making smarter financial decisions in all, all areas of finance? And these were the three things that, you know, that was a big breakthrough in 2002, was the focus group led me to understand what they drew truly valued as far as the outcome of what we were doing for them in such a way that I could help potential clients decide for themselves whether it was worth the fee or not.

Mark: And that that was a big breakthrough. Right,

Ian: right.

Mark: And, um, and there were several other things, but I think the, the only other thing in 2002 that, uh, was worth mentioning, uh, other than the big event in October. But, but the other thing that I did before I kind of finish up here is to say that it was in 2002 that I’d [01:09:00] finalized what the proper team structure should be.

Mark: You know, in working with my focus group, I realized that I couldn’t do everything and that what the proper number of team members should be is five, and that is five skilled subject matter experts. Um, I realized that there were five major areas of finance and that I should have a subject matter expert in each of those five areas.

Mark: Financial planning, money management. Estate planning, insurance and tax. So I finalized that team structure and I, I resolved in 2003 to fill, fill every vacancy on that team. And I did. But the big event, to kind of finish all this off was by October 22nd, 2002, I accepted my final ideal client. I closed the business to new clients and, um, and, and so, uh, that, that acquiring of that hundredth ideal client [01:10:00] was really the, the, the ending of a complete transformation of the business.

Ian: So what was that, what the total time from start to finish,

Mark: the total time was I, the way I count it was in 1999. I met Bill in June, so I didn’t, I kind of fiddled around with the idea until the end of the year. So the way I started the clock ticking in January of 2000.

Ian: Okay.

Mark: That was the, the date that I jumped in the river and really started.

Mark: The transformation of my business. And then, uh, I completed this, I reached my goal. I acquired my hundredth ideal client, paying me over $10,000 a year by October 22nd, 2002. So that’s 34 months from start to finish.

Ian: Yeah. Wow. And that was all referrals, as I understand it,

Mark: a hundred percent referrals. And there were a couple of, couple of funny, kind of unexpected, funny incidents.

Mark: After I closed the firm to new business, I, [01:11:00] I sent around a notice to my, to two groups, my existing ideal clients, and I thanked them for their, you know, help. And I, and I, I talk to them about the fact that now I actually have a bunch of more time since I’m not gonna be doing client acquisition anymore. I kind of recommitted to them that I was gonna invest even more time in figuring out ways to add value to them.

Mark: So that, that was one notice. But the other notice was to, I had a group of people, and it was about 80 people that I had, had an initial client interview with. They did meet the ideal client profile, or presumably, so they seem to, we, we went through it together and they, they, they say they met all the criteria and so, so I had invited them in to join the ideal client community, but just their personality.

Mark: They just said, well, let me think about it. They didn’t join, but they, you know, they said they were interested. So, so I, it’s funny, for [01:12:00] over a year and a half, almost two years, I had sent out a monthly report card. I sent out a little notice to this group and I said, just to keep, you know, just to keep you informed, I’m only gonna have a hundred clients.

Mark: I’m not accepting clients after a hundred and every month I sent out a report card saying, you know, I’ve got 66 of a hundred ideal clients, you know, just in case you’re still thinking about it. And then the next month it might be 72 and then 88, and then a, you know, and then finally I sent the final letter.

Mark: I sent a cover letter on the report card that said, you know, we’re done. We’re not accepting clients. We just accepted our hundredth client. And, uh, just wanted to let you know that, um, we’re not, you know, we’re no longer an option for you. And five of those, I’ll think about it. Clients tried, they were so stunned by this.

Mark: They just couldn’t even imagine. And five of them didn’t believe it. And since all these people came to me via referrals, mostly from, you know, the ideal [01:13:00] clients, five of them tried to pull strings to become clients after I was done because they did not believe that we were actually closed for new business.

Mark: They just had never heard of such thing, and they just didn’t accept it. And in some cases they were really big shots in, in a local corporation dare, like super. Yeah. Like they, they, they just thought they’d never met a problem they couldn’t buy, you know, and they, they, and I just, I, I was, you know, not interested.

Mark: So that was funny. And then the other was that, um, I, I still had clients wanting me to, to conduct a financial roadmap for people. So here I was not accepting clients and I was trying to get out from under all these other, these client acquisition activities, but I had a few existing, I, I had regularly had existing ideal clients saying, yeah, but my, my son, my adult.

Mark: Child is making a mess of their finances and I’m, I’m afraid they’re gonna bring my [01:14:00] grandchildren down with them, you know, and can’t you sit down and complete, you know, my son and daughter-in-law’s financial roadmap and, and I realized I’m not out of this completely. That, uh, you know, the financial roadmap was such a valuable thing that I still accepted.

Mark: I still completed those, but, oh,

Ian: you must have had a steady stream of referrals coming in still at that point.

Mark: I did. That’s the whole point. The whole bottom line to that. And what made it funny was I did continue to sit down with new people and did their, completed their financial roadmap, but at the end, I would always just refer ’em out or just hand ’em their financial roadmap and say, here you go.

Mark: I hope this helps. And the fact that I accepted no clients, it was just led to all these funny situations where people are used to coming into a financial advisor and then hearing some big sales pitch at the end.

Ian: What a shame that you were the only game in town at that point that you didn’t have, uh, uh, that you weren’t mentoring somebody else who could have taken those.

Mark: Yeah. It’s, uh, just the way that it [01:15:00] was. And so anyway, those were a couple of funny little sideline notes, but the, the big thing for me was I changed in the, the day that I accepted my hundredth client ideal client, I, I pulled my staff in for a staff meeting and I had a list of things that were gonna change, and one of them was that my hours were gonna change.

Mark: So, you know, I had been putting in all these hours to build, you know, to acquire new clients and, and to build, build this business model and everything. And, and one of the very first things that I did to change was, I said, from now on, I’m working a three day week. I’m, I’m working Tuesday, Wednesday, Thursday.

Mark: And it, it was a long day. 7:00 AM to 7:00 PM mainly to serve. Ideal clients, Mo most of whom were corporate executives who liked to meet before and after work. So I, I, I agreed Tuesday, Wednesday, Thursday to work, seven to seven to [01:16:00] accommodate my clients. But then I was off for Friday, Saturday, Sunday, Monday.

Mark: So I had four days off and three days on. And that was a big change for me. Uh, I was working 36 hours a week, but I was off four days. And, uh, you know, that was the first time in my career that I had a hope of balancing my life at that point. I mean, you talk about work life balance. I mean, that was, for me, that was the big payoff.